Last week, I had the honor of giving a presentation about Salesforce’s answer to the Quote-to-Cash gap at the Belgium User Group. I introduced Salesforce CPQ and Salesforce Billing, which is about to become a fully integrated Quote-to-Cash product. As the room was packed with an enthusiastic crowd of people eager to learn more about Salesforce Quote-to-Cash, we must recognize that there is indeed a lot of potential for this product. As with all user group meetings, the goal of the presentation was not to sell, but rather to share experiences and to give an honest opinion on both the strengths and the weaknesses of this new product.

You can check the full presentation here, but I listed the key notes below.

What is Quote-to-Cash and why can’t we just do things the old way?

(Video 5 min – 26 min)

Quote-to-Cash encompasses a set of business processes that have been identified as the most important, but sometimes least automated and least well-controlled within companies. As we enter the paradigm of “the age of the customer”, we must admit that customer expectations are at an all-time high. Customer companies can no longer afford the luxury of solely reacting to customer requests, but must offer personalized experiences tailored to every customer’s specific needs to stand out and stay ahead of the competition.

Last week I attended a presentation of one of my dear colleagues. He described that CRM only does an excellent job if the customer feels like he is talking to the same person during every customer interaction. This is only possible if each representative can access all the information he or she requires to deliver you that heightened level of customer service you desire. This illustration recognizes the importance of Salesforce’s 360° view: a complete analysis of the customer that contains information about all crucial business processes.

This leads us to the so-called Quote-to-Cash gap. Companies are not set up for success in this new customer paradigm, as there is a lack of accuracy and completeness of this crucial 360° view. Most of the business processes that are part of Quote-to-Cash are done outside of Salesforce on a separate platform. Manual quoting processes are prone to human error and can cause big issues when the deals are eventually closed. Legacy systems are expensive to maintain, can cause integration headaches and, when additional customization is required, delays in rollouts. In short, companies often find themselves lacking a streamlined set of processes that take control of the complete sales cycle.

Kicking off the Quote-to-Cash process with CPQ

(26 min – 1h 3min)

CPQ is the first half of the Quote-to-Cash offering. Salesforce CPQ is a fully-native solution that offers the sales representatives the necessary tools to make complete and accurate quotes. CPQ does this by adding an additional layer onto the existing Salesforce Sales Cloud.

Firstly, for any CPQ implementation, the most important part is the Product Catalogue. This has a direct impact on the power of the ‘Configure’ part of CPQ: by making the product catalog smarter and enhancing it with business rules, we try to guide sales reps along the path of configuring products and build safeguards to prevent misconfigurations. The product catalog in Salesforce is the most important part of the entire Quote-to-Cash implementation: it is the central piece of the puzzle that drives all business logic downstream.

Secondly, there is the Pricing Engine. CPQ offers a flexible solution for pricing requirements of all sorts, ranging from the more traditional list prices to extensive functionality in which the price is driven by numerous parameters. Additionally, Salesforce CPQ also contains an all-encompassing discount model. As the Sales Cloud has a 360° view of the customer, we can benefit from any information known within the CRM system to apply any automatic discounts or pricing agreements automatically. Furthermore, we can control the flow of additional discounts by making them dependent on the product, the account, or the profile of the sales reps. As some senior sales reps have a proven track record, we might grant them some freedom over discounts to sweeten the deal, while the more junior profiles might trigger an approval.

propose contract

Lastly, CPQ allows us to generate an accurate, complete and professional-looking quote. When we decide to send the quote to our customer, a document is generated that can be delivered on any device. Perhaps you are running a very traditional business in which these things or still done on paper, or perhaps you are looking into a digital transformation towards digital signatures. No matter the case, there is a seamless handoff to the customer to enable your sales rep to close the deal.

A digital copy of this quote remains on our trusted Salesforce platform and is immediately added to our sales pipeline. It can be reported and forecasted upon, it can be shared with other representatives, or your manager might follow up on your progress. As soon as the customer signs our quote, our order and contract management modules take over to get the paperwork done. As this information resides within the Sales Cloud, Salesforce crunches the numbers and complements our 360° view.

Further covering the gap with Salesforce Billing

(1h 3min – 1h 40min)

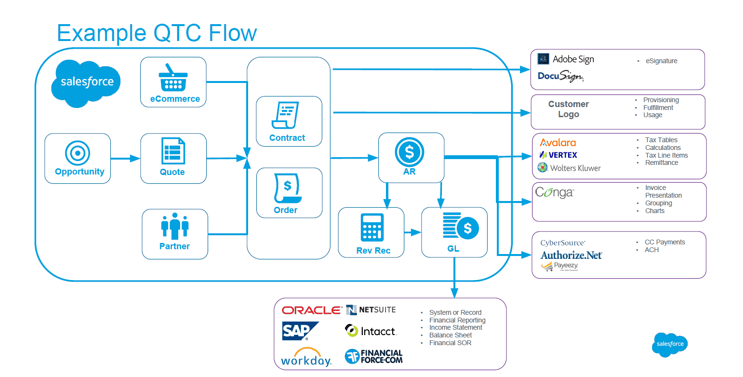

The role of Billing begins once CPQ passes on the necessary information to the engine. Billings’ responsibilities include Account Receivables, Revenue Recognition, General Ledger integration and Order Management. With Quote-to-Cash, Salesforce takes over functionalities that are traditionally done by an ERP. Although Salesforce contains some Finance features, most clients will still have to integrate with another system to do the accounting, but with 3rd party players such as FinancialForce, those processes do not necessarily have to take place outside of Salesforce either.

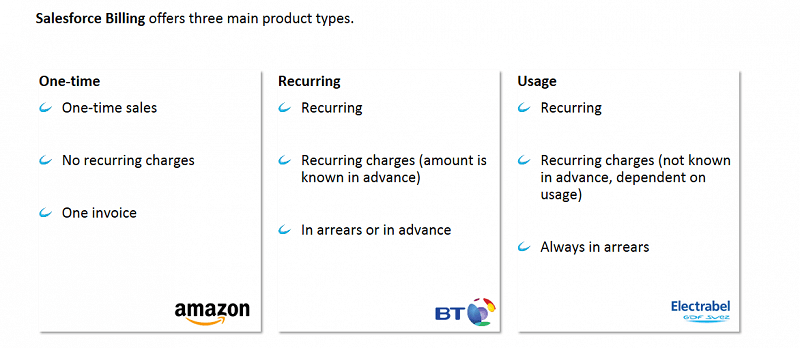

Billing supports three charge types: one-off, recurring and usage. One-off products are items that are invoiced once for a flat amount. Recurring products are invoiced multiple times, depending on their billing frequency and the subscription term. If you have any pricing agreements with a customer, but do not know how many units they will eventually consume, usage products are the way to go: the price is known in advance, and the variable consumption is billed every billing frequency.

The entire process starts when Billing receives an Order. Depending on the business requirements, order fulfillment can vary, but eventually Salesforce must receive a signal (automated if no order fulfillment takes place, through user interaction by changing a field or even over an API when a customer first signs on to the service) that an order is eligible to be billed. In the next invoice run, our invoice scheduler will scan all Order Products, and group them to one or multiple invoices according to our grouping rules, a functionality introduced to seriously reduce paperwork: perhaps two incoming charges of two orders of the same client can be grouped together, or we want to avoid this because one of the orders contains a PO Number. Once our invoices are posted, the accounts receivables process takes place. Cash is collected on Salesforce, by integrating a payment gateway or by loading in incoming bank statements. As this entire process runs on the Salesforce platform, all the information is available and reportable to complement our 360° view. Welcome to the new customer-centric paradigm!

Conclusion

Salesforce is evolving from a CRM system to an enterprise platform that offers a cloud infrastructure for almost any business process. By doing more with a cloud solution like Salesforce, we can drastically reduce time-to-deploy, focus on continuous improvements and save costs. More importantly, all departments are enhanced with a 360° view which allows them to excel in the age of the customer.

Want to talk about evolving your Quote-to-Cash processes? Let’s talk.

Are you looking for hands-on training on Salesforce Quote-to-Cash for your in-house admins or consultants? Contact us.

Want to know more about Quote-to-Cash or looking to get certified?

- About CPQ & Billing

- Looking to get certified?

- Salesforce CPQ Basics Trailhead